Brick-and-mortar retailers are under pressure due to growing e-commerce.

This is sometimes taken to the extremes, stating the end of physical

stores in near future. "How can I fight Amazon?" is a commonly asked

question.

The definite answer is that brick-and-mortar stores are here to stay.

Combining physical locations with e-commerce capabilities, we are

entering to an era of customer bliss where customer

experience means something.

Sure, but what does it actually mean for retailers?

The landscape of commerce is changing and retailers do need to go with

it to continue making revenue. Doug Stephens in his book The Retail

Revival suggest that we are in the middle of the market dividing into

two opposites of searching for experience or ease. He is backed up by

John Gerzema and Michael D'Antonio who in their book Spend Shift argue

that consumers are disregarding what has known to be middle-class

average to experience high-fidelity or convenience.

What do they mean by this? On one hand consumers enjoy an easy access to

a variety of products - convenience. A good example for this is Amazon

with its unprecedented selection of products that are easier to purchase

than ever before.

On the other hand, the consumer is looking for unique experiences

coupled with high touch service, or in other words high-fidelity.

Stephen has even suggest a new metric to be take into consideration to

support this: experiences per square meter.

It is not as simple cut as consumer being one or the other, however.

Your average buyer might log onto Amazon to make a 5-minute purchase of

slacks for $15 after they had a concierge like service buying a

classical Burberry trench coat for $2,000.

In this new age, the consumer is a creature who economizes on products

s/he doesn’t care about so s/he could spend excessively on things that

matter.

Facing this consumer, retailers need to ask what are they offering -

fidelity or convenience.

To understand today’s consumers and why they spend on average 500% more

than their parents in the same age, and how retailers can tap into this

potential, we need to know where they came from.

Birth of retailing as we know it

Second half of 1940s saw the beginning of what was later states as the

beginning of retailers heaven. Until 1960s, US continued having increase

in births from year to year establishing the baby-boomers generation.

Simply put - there were new consumers born every day more than ever

before.

The generation born during baby-boomers are also known as the Jones for

their eagerness to be like everyone else (or at least like their

neighbors). “Keeping up with the Joneses” was a well sought after

mahtra.

For retailers this meant having an increased amount of buyers who were

looking for the same thing (what the neighbor has) making them similar

in their consumption habits.

The majority of consumers were mostly white, middle-class children from

two-parents, single-income homes. They wore similar clothes, ate similar

food and lived a similar lifestyle.

All retailers needed to do was to meet the demands of an ever growing

population that created a market of fairly homogenous buyers.

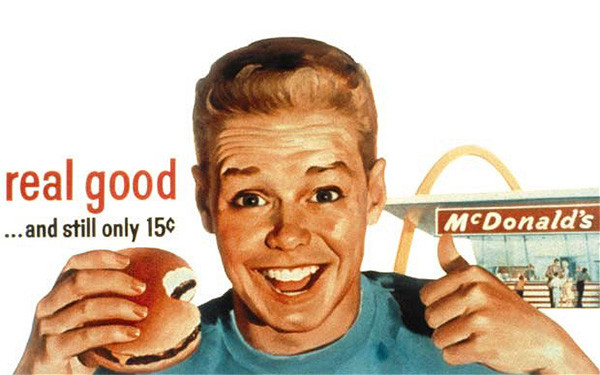

By the 1960s the Joneses kids were in grade school, listening to the

Beatles sing A Hard Day's

Night while eating

a McDonalds burger 15 pennies a piece. With them grew the demand for

more clothes, toys, food and everything else. New stores were popping up

and today’s retail giants like Best Buy, MasterCard, PepsiCo, Wallmart,

Target and many others were established.

James is happy with his burger. The same burger that all of his friends

are eating and loving.

During 1970s the baby-boomers had grown up, entered the working force to

bring home salaries themselves and married to have kids of their own.

The sheer mass of babies born a decade ago were starting to make their

own money and spending it too.

A retail bliss!

Retailers went on a building frenzy, constructing bigger and bigger

shopping centers. Stephens calls this the retail industrialization, a

time when retailing ceased to be a craft and instead became an

occupation.

The new era would bear witness to the displacement of personal service,

unique products and artful merchandising by stack-outs, blowouts and

rollbacks. Quality would take a back seat to availability, and abundance

would triumph over substance.

The Joneses are gone

Baby-boomers themselves failed to give birth to an ever growing army of

consumers. Their kids, the Generation X is at least 15% smaller. It's

nearly impossible for them to fuel the economy through everyday shopping

the same way as their parents did.

Stephens and Gerzema-D'Antonio suggest that the current situation of

retail isn't a dragged out recession like many would like to believe but

an end of the 50 year long era that resembles hazed college years

beer-party extravaganza. Many of those brands established in the 60s are

experiencing the following hangover coupled with confusion.

More-so the era of middle-class Joneses, where everyone wanted to be

like everyone else, is over. During the past 50 years many changes have

occurred in the way people live, access to diverse backgrounds and

opinions, the new debt filled rules of economy and many more. Buyers are

returning to pre-baby-boomers era of consumption when quality trumps

quantity and craftsmanship is back in fashion.

Consumers these days aren't as simply cut as they were just few decades

ago, demanding more from brands.

In his book Trade-Off: Why Some Things Catch On, and Others Don't

author, Kevin Maney, explains the difference of what he believes to be

the new norm in consumption where buyers choose between fidelity and

convenience.

"Fidelity is the total experience of something"- a brand, a retailer or

a product - the sum total of price, service, merchandising, product

quality and so on wrapped up into the feeling the consumer walks away

with.

Convenience-based experiences, on the other hand, are comparatively

ubiquitous, accessible and inexpensive. They are less about the

experience and more about the sheer ease with which a product or service

can be acquired.

The question that retailers need to ask themselves is - in which

category do I belong? The middle ground is a deadzone of brands who

consumers can’t trust to be one or the other. Think of it as the

poisonous fog Jennifer Lawrence needed to battle in The Hunger Games.

Understanding product and service

In high-fidelity, the service or product is exclusive, premium priced,

has limited availability/distribution, provides concierge level of

service, have niche appeal and in the end the

consumer develops emotional connection.

A typical high-convenience product would be ubiquitous, low prices,

available through multiple channels/mass, low service or self-service,

have wide appeal and consumer forms cognitive a connection.

Retailers should be aware that this isn't as simple question between

cheap versus expensive products and services. Stephens brings an

illustrating example between buying a coffee in Starbucks or Dunkin

Donuts where the price of the coffee can be the same, but the experience

that the buyer receives is very different.